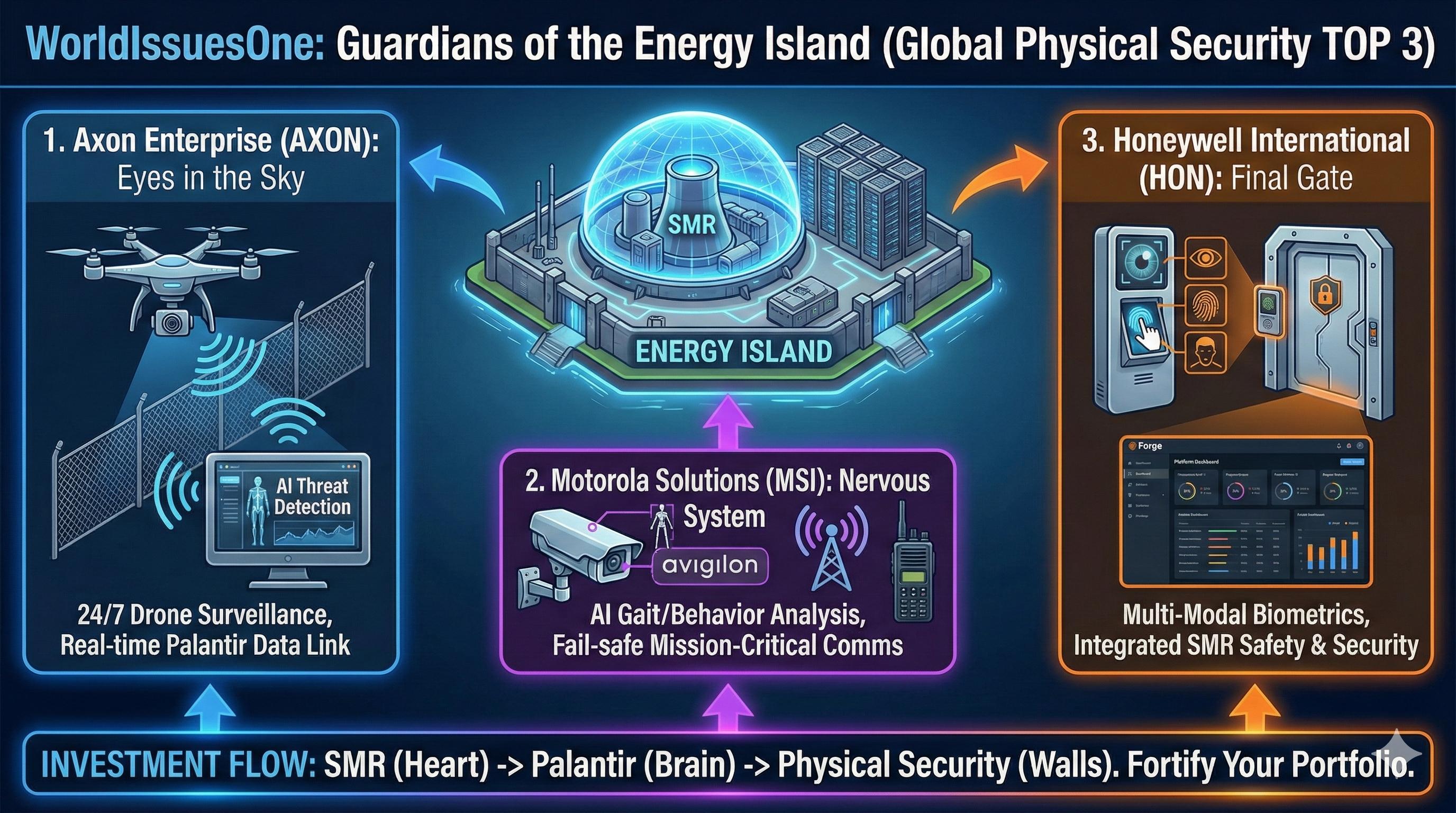

Guardians of the Energy Island:Global Physical Security Top 3 Report

Date: January 25, 2026

Analysis Theme: Physical Layer Security: Defending the "Energy Island"

An "Energy Island" is far more than a mere building; it is a high-value strategic hub where multi-billion dollar SMRs (Small Modular Reactors) and national-level classified data converge. To protect these assets, an integrated physical security solution—combining drone surveillance, intelligent video analytics, and biometrics—is no longer optional; it is essential.

1. Axon Enterprise (Ticker: AXON)

"Unifying 'Eyes in the Sky' with Non-Lethal Defense"

● Core Technology: Axon Air (Drone Security) and Axon Evidence (Digital Evidence Management & Data Integration).

● Investment Thesis: Once famous solely for its Tasers, Axon has transformed into a dominant powerhouse in drone-based security. Its systems provide 24/7 autonomous drone surveillance over the vast perimeters of Energy Islands. In the event of an anomaly, Axon shares data in real-time with Palantir’s AIP for immediate, coordinated tactical response.

● 2026 Outlook: As global data center complexes undergo "fortification," orders for Axon’s security drone systems have surged by over 45% year-over-year.

2. Motorola Solutions (Ticker: MSI)

"The King of Intelligent Video Analytics and Mission-Critical Communications"

● Core Technology: Avigilon (AI-driven Video Analytics) and Private/Mission-Critical Networks.

● Investment Thesis: Moving far beyond traditional CCTV, Motorola owns the technology to analyze gait and behavioral patterns of intruders via AI, triggering alerts before a breach even occurs. Crucially, they provide proprietary wireless communication networks that remain operational even in signal-jammed or grid-failure environments, ensuring the security system never goes dark.

● 2026 Outlook: Driven by the demand for "Sovereign AI," Motorola now commands over 60% of the closed security network market, continuing a streak of significant earnings surprises.

3. Honeywell International (Ticker: HON)

"Industrial Automation Security for Reactors and Data Centers"

● Core Technology: Honeywell Forge (Industrial Cyber-Physical Integrated Security Platform) and Multi-Modal Biometric Access Control.

● Investment Thesis: Honeywell is deeply embedded in the process control systems of nuclear facilities like NuScale Power (SMR). They supply the "Final Gate" security for reactor rooms using multi-modal biometrics—including facial, vein, and iris recognition. They are the only player capable of managing both the "Safety" of the infrastructure and its "Security" simultaneously.

● 2026 Outlook: By evolving beyond hardware into integrated Energy Management Systems (EMS) with embedded security, Honeywell stands as a primary beneficiary of the 2026 infrastructure super-cycle.

📈 Investment Strategy Summary

WorldIssuesOne Tip: Investment capital follows a specific sequence in the Energy Island era: SMR (The Heart) → Palantir (The Brain) → Physical Security (The Fortress Walls). While the market is currently fixated on the "Brain," savvy investors are already moving into the "Walls" as order backlogs for these three titans hit record highs.

https://youtu.be/oRTrzDCTD2c?si=2XWLGJKxsf1YJGtx